The Australian Healthcare sector is continuing its positive trend. Check its 1-year chart below:

The

index has performed strongly over the past 4 months, gaining over 24%. I continue feeling bullish about this sector and will be

looking to enter into more positions though Russia's ruble problems have me on edge.

Below is my updated watchlist:

SRX.AX, CUV.AX, IPD.AX, SOM.AX, CAJ.AX, FPH.AX, NAN.AX, API.AX

NEU.AX, UNS.AX, RVA.AX, PXS.AX, PME.AX

RHC.AX, COH.AX

IMC.AX, PGC.AX, LCT.AX, BLT.AX, AVH.AX

Note - Of the mentioned stocks I am already long on NEU, UNS, FPH, BLT, AVH, LCT, & SRX. I do not enter in short positions.

Monday, December 29, 2014

Sunday, December 14, 2014

I am a Marketocracy Master now!! (bench)

Marketocracy has recognized my Portfolio's stella long-term performance and promoted me to their Top Portfolios Managers list.

Over the last 10 years my Portfolio has beaten the performance of all USA listed Morningstar Mutual Funds.

This link shows my Funds performance: http://www.marketocracy.com/managers.php?manager=781

Now US citizens can invest in my Portfolio through a SMA with foliofn.

disclosure: I get 0.3% commissions on all funds in my Fund.

Over the last 10 years my Portfolio has beaten the performance of all USA listed Morningstar Mutual Funds.

This link shows my Funds performance: http://www.marketocracy.com/managers.php?manager=781

Now US citizens can invest in my Portfolio through a SMA with foliofn.

disclosure: I get 0.3% commissions on all funds in my Fund.

Wednesday, December 3, 2014

US Healthcare Stocks Watchlist - updated Dec 2014

I am in a strong BUY mode.

Below is my short-list of stocks also showing strong positive price movements:

IG RDNT TGTX CMRX PTX AGN EW

AGIO OVAS RCPT TTPH ANAC PTCT SCLN PAHC XNPT

NWBO ANIP OMER ESPR SCMP RNA IMUC MBVX

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Below is my short-list of stocks also showing strong positive price movements:

IG RDNT TGTX CMRX PTX AGN EW

AGIO OVAS RCPT TTPH ANAC PTCT SCLN PAHC XNPT

NWBO ANIP OMER ESPR SCMP RNA IMUC MBVX

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Thursday, November 27, 2014

ASX Sharemarket Game 2 2014 - dubious winners announced!

I cannot believe the portfolio returns of the announced winners!

I sent this email to the games organizers.

"Hi,

I find this games results very unbelievably.

A portfolio return of over 300% with no shorting available and no individual stock returning near 300%. And all this return in a negative market environment, and performed by only a handful of funds that were managed by novices!?

Please this is too much to believe and accept and that's coming from a trader with over a decade of experience.

Have you checked all the trades and their date and time stamps and verified they were not retrospective? Is your site secure enough? was it possibly hacked? do the winners/novices have a background it IT?

I would like to think you have already made these investigations but am still not convinced about the legitimacy of their portfolio returns.

I was in your top30 after several weeks of the comp but stopped playing after I saw the dubious returns of the handful of leaders, I thought then they were cheating and am not convinced they weren't.

Looks like they earned over $18,000 with their exploits!

I and my friends will not be playing your game next year unless you can convince us that the game is fair.

Regards,

Branko Krstevski."

I sent this email to the games organizers.

"Hi,

I find this games results very unbelievably.

A portfolio return of over 300% with no shorting available and no individual stock returning near 300%. And all this return in a negative market environment, and performed by only a handful of funds that were managed by novices!?

Please this is too much to believe and accept and that's coming from a trader with over a decade of experience.

Have you checked all the trades and their date and time stamps and verified they were not retrospective? Is your site secure enough? was it possibly hacked? do the winners/novices have a background it IT?

I would like to think you have already made these investigations but am still not convinced about the legitimacy of their portfolio returns.

I was in your top30 after several weeks of the comp but stopped playing after I saw the dubious returns of the handful of leaders, I thought then they were cheating and am not convinced they weren't.

Looks like they earned over $18,000 with their exploits!

I and my friends will not be playing your game next year unless you can convince us that the game is fair.

Regards,

Branko Krstevski."

Friday, November 21, 2014

My other US Stock Watchlists

Technology

PANW SWKS SMCI VDSI VIPS TQNT AVGO

AMBA TTGT

RDCM AMOT SWIR PLNR

Energy

TGS ETE

TCP MUSA CVA

MPLX TEP WLB

Discretionary

STRA MAR RCL VAC

EROS RDI LEG HKTV

Materials

LAWS OFLX RIC

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com

PANW SWKS SMCI VDSI VIPS TQNT AVGO

AMBA TTGT

RDCM AMOT SWIR PLNR

Energy

TGS ETE

TCP MUSA CVA

MPLX TEP WLB

Discretionary

STRA MAR RCL VAC

EROS RDI LEG HKTV

Materials

LAWS OFLX RIC

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com

Saturday, November 8, 2014

US Healthcare Stocks Watchlist - updated Nov 2014

US markets are trending positively, check Nasdaq chart below:

Similarly the Nasdaq Biotech index is also positive, check its chart below:

I am in strong BUY mode.

Below is my short-list of stocks also showing strong positive price movements:

IG RDNT MACK CBPO TGTX AGN EW MNK

AGIO SCLN AVNR TTPH ANAC OVAS RGEN AKRX EXAS

NWBO UNIS RCPT ANIP MDXG ESPR

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Similarly the Nasdaq Biotech index is also positive, check its chart below:

I am in strong BUY mode.

Below is my short-list of stocks also showing strong positive price movements:

IG RDNT MACK CBPO TGTX AGN EW MNK

AGIO SCLN AVNR TTPH ANAC OVAS RGEN AKRX EXAS

NWBO UNIS RCPT ANIP MDXG ESPR

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Sunday, September 14, 2014

2014 Fantasy NRL season is over (sportsbet.com.au)

Congrats to Shevket's Shevs Boys team which is this season's winner. This prize is a stressful $5,000 free bet.

Shevket is a very deserving winner he build a very balanced and strong town from the beginning of the season. He then managed his trades well enough to dominate the Leaderboard all season long while thousands of us tried to chase him down. Well done Shevket and good luck with that prize!

I finished ranked 19th overall so no major prizes for me but I won four of my League finals and had fun playing. I may play again next season if I have time.

Shevket is a very deserving winner he build a very balanced and strong town from the beginning of the season. He then managed his trades well enough to dominate the Leaderboard all season long while thousands of us tried to chase him down. Well done Shevket and good luck with that prize!

I finished ranked 19th overall so no major prizes for me but I won four of my League finals and had fun playing. I may play again next season if I have time.

Thursday, September 4, 2014

ASX Sharemarket Game 2 2014 - update

After a month in this competition Becky from NSW is our clear leader with a huge portfolio return of 65.4%. Second is Jakem from Victoria with am impressive return of 41.4%. The All Ord Index has returned 5.6% over this same time-period.

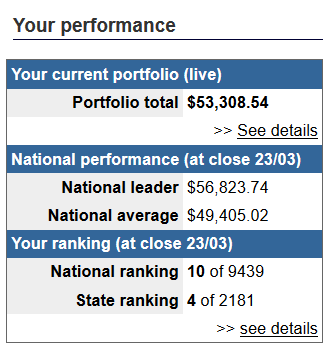

I am ranked 28th with a return of 18.4%. I am pleased to have climbed onto the Leaderboard but am still a long way from the summit so I will be sticking with a most aggressive strategy to try and get to the summit. This competition has only 1 prize for the winner so finishing second or last all pay the same. Check my performance summary below:

I am currently fully invested in my favorite biotechnology sector. My two largest holdings are MSB.AX (Mesoblast) and SRX.AX (Sirtex).

Mesoblast is my best performer, since August this stock is up over 36%. The catalyst for their sharp price movement was their company announcement that they had entered into an agreement with The US National Institute of Health to run a 120-patient trial in end-stage heart failure using their adult stem cell therapy.

Not sure how much higher this stock will run in the short term, I will continue to hold it until it shows weakness. From a longer-term investment perspective I think this stock has tremendous potential. Below is their 12 month chart:

Sirtex has been trending strongly also, its August return was over 24%.

Sirtex's price has benefited from strong sales growth of their liver cancer treatments. They also have more liver cancer treatments being trialed in their pipeline. I like this company's short and long term prospects.

I wont disclose any more of my holdings for now, I am chasing the main prize!

Note - The mentioned stocks are traded in a stock market game simulator. Real money is not used.

I am ranked 28th with a return of 18.4%. I am pleased to have climbed onto the Leaderboard but am still a long way from the summit so I will be sticking with a most aggressive strategy to try and get to the summit. This competition has only 1 prize for the winner so finishing second or last all pay the same. Check my performance summary below:

I am currently fully invested in my favorite biotechnology sector. My two largest holdings are MSB.AX (Mesoblast) and SRX.AX (Sirtex).

Mesoblast is my best performer, since August this stock is up over 36%. The catalyst for their sharp price movement was their company announcement that they had entered into an agreement with The US National Institute of Health to run a 120-patient trial in end-stage heart failure using their adult stem cell therapy.

Not sure how much higher this stock will run in the short term, I will continue to hold it until it shows weakness. From a longer-term investment perspective I think this stock has tremendous potential. Below is their 12 month chart:

Sirtex has been trending strongly also, its August return was over 24%.

Sirtex's price has benefited from strong sales growth of their liver cancer treatments. They also have more liver cancer treatments being trialed in their pipeline. I like this company's short and long term prospects.

I wont disclose any more of my holdings for now, I am chasing the main prize!

Note - The mentioned stocks are traded in a stock market game simulator. Real money is not used.

Wednesday, August 27, 2014

Australian Healthcare Stocks Watchlist - updated

The Australian Healthcare sector is continuing on a positive trend. Check 1-year chart below:

The index performed particularly well this month gaining nearly 11% from its monthly low. I still feel bullish about this sector and will be looking to enter into more positions.

Below is my updated watchlist:

FPH.AX, GXL.AX, AZV.AX, RHC.AX, OBJ.AX, SIP.AX

SRX.AX, BIT.AX, COH.AX,

MSB.AX, CUV.AX, BNO.AX, UNS.AX, PGC.AX, ACR.AX

LCT.AX, BLT.AX, AVH.AX, NEU.AX

Note - Of the mentioned stocks I am already long on FPH, GXL, BLT, AVH, & NEU. I do not enter in short positions.

The index performed particularly well this month gaining nearly 11% from its monthly low. I still feel bullish about this sector and will be looking to enter into more positions.

Below is my updated watchlist:

FPH.AX, GXL.AX, AZV.AX, RHC.AX, OBJ.AX, SIP.AX

SRX.AX, BIT.AX, COH.AX,

MSB.AX, CUV.AX, BNO.AX, UNS.AX, PGC.AX, ACR.AX

LCT.AX, BLT.AX, AVH.AX, NEU.AX

Note - Of the mentioned stocks I am already long on FPH, GXL, BLT, AVH, & NEU. I do not enter in short positions.

Thursday, August 7, 2014

NRL Sportsbet Fantasy Competition - Round21

5 rounds left in the Sportbet's Fantasy NRL competition.

I am an outside chance of winning this game, my current rank is 38th and I only have 1 trade up my sleeve.

Most people on the Leaderboard suffered heavily from last round's injury toll. Fantasy guns such as Fensom, A Taylor, Cartwright, Graham all got injured and are out for the season.

Fortunately my team has some depth so I've just needed to replace Fensom. Hopefully my competitors are in much worse shape.

Below I've list a few value players worth trading into your team should you have trades left:

T Symonds (MNL) $218k

I Yeo (PTH) $204k

C Sironen (WST) $220k

D Halatau (WST) $154k

J Buhrer (MNL) $329k

A Fifita (CRO) $363k

A Woods (WST) $372k

R Farah (WST) $398k

P Gallen (CRO) $444k

T Merrin (STG) $346k

I am an outside chance of winning this game, my current rank is 38th and I only have 1 trade up my sleeve.

Most people on the Leaderboard suffered heavily from last round's injury toll. Fantasy guns such as Fensom, A Taylor, Cartwright, Graham all got injured and are out for the season.

Fortunately my team has some depth so I've just needed to replace Fensom. Hopefully my competitors are in much worse shape.

Below I've list a few value players worth trading into your team should you have trades left:

T Symonds (MNL) $218k

I Yeo (PTH) $204k

C Sironen (WST) $220k

D Halatau (WST) $154k

J Buhrer (MNL) $329k

A Fifita (CRO) $363k

A Woods (WST) $372k

R Farah (WST) $398k

P Gallen (CRO) $444k

T Merrin (STG) $346k

Tuesday, August 5, 2014

2014 ASX Stockmarket Game2 - my tips

The Game2 contest begins this week, Thursday the 7th of August. And it runs for a little over 3 months, till 19th of November. Here is the link to the game:

http://www.asx.com.au/education/sharemarket-games.htm

I will be constructing my fund with momentum stocks as the ASX Index is trending positively as is the US's Nasdaq, check charts below:

Momentum stocks usually do well under these market conditions. I have listed below my latest stock shortlist:

GXL.AX GEM.AX APN.AX VOC.AX IPP.AX MQA.AX CFR.AX

SIP.AX SRX.AX IGO.AX SKI.AX AWC.AX

OGC.AX SAR.AX SIR.AX SYR.AX WSA.AX NST.AX

ACR.AX ROC.AX KAR.AX SEA.AX EGP.AX EWC.AX TTS.AX

some bottom feeders next:

aax asl brl cda kcn pdn rfe

ari mrm pbt sbm wdr

This time we can choose stocks from the entire ASX300 list. We have a couple of days left to finalize our picks.

Remember there is only 1 prize, the winner takes all, a cool AU$8,000. So I will be minimizing my diversification to give myself a chance at achieving a really high return.

Beware this type of strategy can also give you a really low return.

Good luck!

& hope to see you on the Leader-board

http://www.asx.com.au/education/sharemarket-games.htm

I will be constructing my fund with momentum stocks as the ASX Index is trending positively as is the US's Nasdaq, check charts below:

Momentum stocks usually do well under these market conditions. I have listed below my latest stock shortlist:

GXL.AX GEM.AX APN.AX VOC.AX IPP.AX MQA.AX CFR.AX

SIP.AX SRX.AX IGO.AX SKI.AX AWC.AX

OGC.AX SAR.AX SIR.AX SYR.AX WSA.AX NST.AX

ACR.AX ROC.AX KAR.AX SEA.AX EGP.AX EWC.AX TTS.AX

some bottom feeders next:

aax asl brl cda kcn pdn rfe

ari mrm pbt sbm wdr

This time we can choose stocks from the entire ASX300 list. We have a couple of days left to finalize our picks.

Remember there is only 1 prize, the winner takes all, a cool AU$8,000. So I will be minimizing my diversification to give myself a chance at achieving a really high return.

Beware this type of strategy can also give you a really low return.

Good luck!

& hope to see you on the Leader-board

Thursday, July 24, 2014

My Marketocracy Stock Watchlist - July 2014

Energy

ETE LNG FANG CPE ENSV ypf eqm crzo mtdr gst amtx

XEC NBR ATHL EMES REX WLB WRES nfx pes axas peix mpet

enph

Healthcare (>10B MCap)

HCA azn act alxn ilmn myl snn

SHPG teva wlp hum

Healthcare (all)

SLXP PCRX SEM GWPH ANIK ig

SHPG QCOR ITMN AKRX RGEN FLML CCM ENZ ilmn bdsi

fold onty

Discretionary

MAR RCL H har spb xrs

DRII twx ea

gluu

Materials

AA CENX ZINC

WLK SLCA SWC GPRE HCLP NNBR cstm ls

CXDC SSLT

aks

Technology

MU AVGO NXPI VIPS SUNE BITA CODE SIMO vnet smci

SWKS TQNT TSEM PXLW arrs stv

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com

ETE LNG FANG CPE ENSV ypf eqm crzo mtdr gst amtx

XEC NBR ATHL EMES REX WLB WRES nfx pes axas peix mpet

enph

Healthcare (>10B MCap)

HCA azn act alxn ilmn myl snn

SHPG teva wlp hum

Healthcare (all)

SLXP PCRX SEM GWPH ANIK ig

SHPG QCOR ITMN AKRX RGEN FLML CCM ENZ ilmn bdsi

fold onty

Discretionary

MAR RCL H har spb xrs

DRII twx ea

gluu

Materials

AA CENX ZINC

WLK SLCA SWC GPRE HCLP NNBR cstm ls

CXDC SSLT

aks

Technology

MU AVGO NXPI VIPS SUNE BITA CODE SIMO vnet smci

SWKS TQNT TSEM PXLW arrs stv

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com

Monday, June 30, 2014

US Healthcare Stocks Watchlist - updated June2014

Below is my list of companies showing strong positive price movements:

SHPG PCRX GWPH AXDX ANIK DRTX ANIP IG

ITMN AKRX LCI ENTA RGEN BDSI FLML ENZ

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

SHPG PCRX GWPH AXDX ANIK DRTX ANIP IG

ITMN AKRX LCI ENTA RGEN BDSI FLML ENZ

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Friday, June 27, 2014

Australian Healthcare Stock Watchlist - updated june2014

Below is my updated ethical Watchlist.

I have adjusted my screener to include the 90 largest capped Australian listed companies. This list shows the stocks with the best momentum and a few speculative stocks that I like on the last line.

FPH.AX, GXL.AX, AZV.AX

SIP.AX, ALT.AX, CMP.AX, SRX.AX, CUV.AX, BIT.AX

GBI.AX, MDG.AX

more speculatives:

BNO.AX, ELX.AX, BLT.AX, ADO.AX, CZD.AX, PGL.AX, AVH.AX, NEU.AX, LCT.AX

happy investing!

Note - I now own AVH.AX, BLT.AX, NEU.AX, & FPH.AX and I may initiate other positions in the next couple of days.

I have adjusted my screener to include the 90 largest capped Australian listed companies. This list shows the stocks with the best momentum and a few speculative stocks that I like on the last line.

FPH.AX, GXL.AX, AZV.AX

SIP.AX, ALT.AX, CMP.AX, SRX.AX, CUV.AX, BIT.AX

GBI.AX, MDG.AX

more speculatives:

BNO.AX, ELX.AX, BLT.AX, ADO.AX, CZD.AX, PGL.AX, AVH.AX, NEU.AX, LCT.AX

Note - I now own AVH.AX, BLT.AX, NEU.AX, & FPH.AX and I may initiate other positions in the next couple of days.

Monday, June 16, 2014

My best Marketocracy Fund

My fund, BK11 continues to feature in Marketocracy's M100.

Marketocracy is about to release updated rankings.

My fund will slip from #1 to #3 in the rankings for 4 year returns.

This fund held the #1 ranking for the 5 previous quarters. I unfortunately incurred heavy losses during the biotech sell-off earlier this year which has hurt my ranking.

I have re-shuffled my fund's positions, it is now back in an aggressive posture. Should the general market rally positively my fund should see large returns. Below are its holdings:

This is the updated Top10 4year ranking:

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Marketocracy is about to release updated rankings.

My fund will slip from #1 to #3 in the rankings for 4 year returns.

This fund held the #1 ranking for the 5 previous quarters. I unfortunately incurred heavy losses during the biotech sell-off earlier this year which has hurt my ranking.

I have re-shuffled my fund's positions, it is now back in an aggressive posture. Should the general market rally positively my fund should see large returns. Below are its holdings:

This is the updated Top10 4year ranking:

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Monday, June 9, 2014

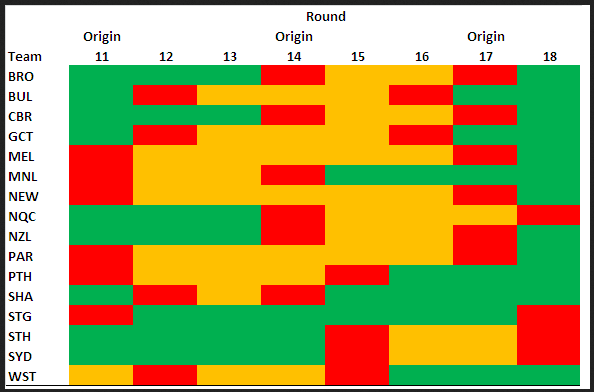

Fantasy NRL Cheat-sheet - the byes & origins simplified

At Sportsbet.com you can make 2 trades per round (and up to 3 in multi-bye rounds 14, 15, 17 and 18).

Friday, May 30, 2014

My US Stocks Watchlist - May 2014

LNG FANG CRZO PVA GST CPE ENSV

EMES PSXP CRK BAS PES REX AXAS WLB

Healthcare

FRX PCRX HZNP AXDX ANIK RGEN CUR ANIP IG

QCOR ITMN RDNT

Discretionary

MAR RCL H LYV SWHC CKEC HAR SNA

EA

RDI

Materials

DOW HCLP LYB NNBR POL WLK

AA CENX GPRE SLCA SWC

CXDC SSLT

Technology

MU NXPI VIPS SUNE BITA MITL

Z ARRS TQNT GTAT AMKR MXWL

Our market sentiment has changed to positive according to Nasdaq's chart. Nasdaq is now charting above its 50-day running average.

I am using all my cash to buy into the market.

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in game at Marketocracy.com

Thursday, May 29, 2014

Australian Healthcare Stocks - Updated Watchlist

Below is my new Watchlist:

FPH GXL MYX

SRX BKL PME ADO

SHL RHC GLH CAJ PHG

BLT LCT IVX AVH TIS PRR NEU

The Australian Healthcare Index is traveling positively, check chart below. I am looking to move out of cash in the coming days.

happy investing!

Note - I now own AVH.AX, BLT.AX, NEU.AX, & FPH.AX and I may initiate other positions in the next couple of days.

FPH GXL MYX

SRX BKL PME ADO

SHL RHC GLH CAJ PHG

BLT LCT IVX AVH TIS PRR NEU

The Australian Healthcare Index is traveling positively, check chart below. I am looking to move out of cash in the coming days.

Note - I now own AVH.AX, BLT.AX, NEU.AX, & FPH.AX and I may initiate other positions in the next couple of days.

Sunday, May 11, 2014

NRL Fantasy on Sportsbet.com - Round 8

My team is playing well, ranked #59 overall, just off the Leaderboard.

This week I won my second weekly prize ($20 free bet) for placing 6th for the round.

I have listed below the key players this season so far and their stats, this info will be useful reference material for the tricky upcoming bye and state-of-origin rounds.

@ Centres

@ Fullback

@ 5/8

@ Halfback

This week I won my second weekly prize ($20 free bet) for placing 6th for the round.

I have listed below the key players this season so far and their stats, this info will be useful reference material for the tricky upcoming bye and state-of-origin rounds.

@ Centres

| Ave score | player | team | salary (100K) |

| 38 | B Thompson | WST | 272 |

| 31 | J Lyon | MNL | 236 |

| 30 | J Idris | PTH | 217 |

| 40 | M Proir | SHA | 273 |

| 32 | L Brown | PTH | 223 |

| 30 | I Yeo | PTH | 87 |

| 27 | N Laumape | NZ | 161 |

| 24 | B Ryan | SHA | 139 |

| 23 | C Rona | NQL | 87 |

| 22 | K Auva'a | STH | 106 |

@ Fullback

| Ave score | player | team | salary (100K) | ||

| 28 | Nightinggale | STG | 202 | ||

| 28 | J Mansour | PTH | 186 | ||

| 26 | G Widdop | STG | 186 | ||

| 24 | B Ryan | SHA | 139 | ||

| 22 | A Johnson | STH | 87 | ||

| 22 | B Hampton | MEL | 132 |

@ 5/8

| Ave score | player | team | salary (100K) |

| 45 | J Paulo | PAR | 327 |

| 36 | J Sutton | STH | 255 |

| 30 | B Austin | WST | 170 |

@ Halfback

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

@ Front Row |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

@ 2nd Row |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Saturday, April 26, 2014

My US Stocks Watchlist - April 2014

Energy

FANG CRR CRZO MTDR EMES FTK PVA CPE NOA

LNG PSXP CWEI BAS REX

SGY CRK PES AXAS WRES MPET

Healthcare

KND PTRA STAA CUR FLML IG

QCOR SEM PMC CORT ENZ PTN HZNP ANIP

Discretionary

MAR H HAR SNA

DLB DV CECO

Materials

CSTM SBGL HCLP CBT POL SLCA ACET

AA CENX USEG LSG

CXDC

Technology

NXPI HOLI MU AVGO VIPS SUNE

SWKS LSCC OCLR HPJ

TQNT MXWL

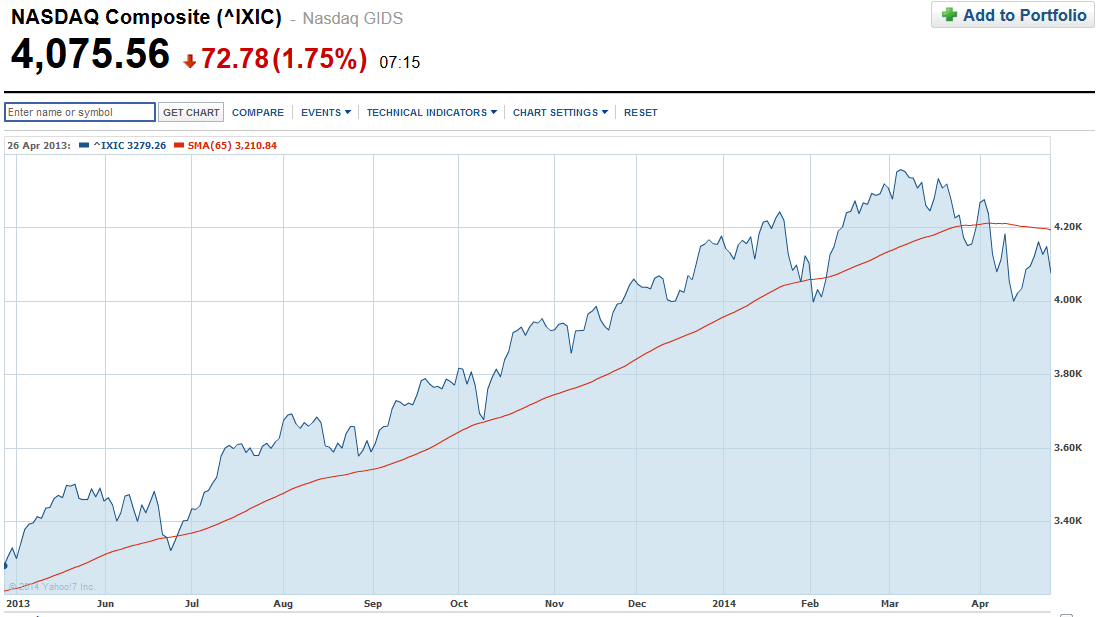

Our market sentiment appears to have turned negative. Nasdaq is now charting below its 65-day running average, check chart below, stocks making new lows are also out-numbering new highs.

Be careful about buying into these market conditions, I will be waiting to see the Nasdaq raise above its 65-day running average before I re-enter the market in a substantial way.

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in games at Marketocracy.com & wallstreetsurvivor.com

FANG CRR CRZO MTDR EMES FTK PVA CPE NOA

LNG PSXP CWEI BAS REX

SGY CRK PES AXAS WRES MPET

Healthcare

KND PTRA STAA CUR FLML IG

QCOR SEM PMC CORT ENZ PTN HZNP ANIP

Discretionary

MAR H HAR SNA

DLB DV CECO

Materials

CSTM SBGL HCLP CBT POL SLCA ACET

AA CENX USEG LSG

CXDC

Technology

NXPI HOLI MU AVGO VIPS SUNE

SWKS LSCC OCLR HPJ

TQNT MXWL

Our market sentiment appears to have turned negative. Nasdaq is now charting below its 65-day running average, check chart below, stocks making new lows are also out-numbering new highs.

Be careful about buying into these market conditions, I will be waiting to see the Nasdaq raise above its 65-day running average before I re-enter the market in a substantial way.

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in games at Marketocracy.com & wallstreetsurvivor.com

Sunday, April 13, 2014

Australian Biotechnology Stocks

Below is my Watchlist.

FPH MYX CAJ PHG PBP

ADO SIP

BKL CUV BIT

AVH TIS

Australian Biotech stocks are traveling nicely unlike their American cousins.

US biotechs have seen a major sell-off over the last couple of months.

The Proshares Biotechnology Index (BIB) is down nearly 40% since its late Feb highs. Check chart below.

Note - I do not own any of the mentioned stocks though I may initiate several positions in the next couple of days.

FPH MYX CAJ PHG PBP

ADO SIP

BKL CUV BIT

AVH TIS

Australian Biotech stocks are traveling nicely unlike their American cousins.

US biotechs have seen a major sell-off over the last couple of months.

The Proshares Biotechnology Index (BIB) is down nearly 40% since its late Feb highs. Check chart below.

Note - I do not own any of the mentioned stocks though I may initiate several positions in the next couple of days.

Monday, March 24, 2014

2014 ASX Stockmarket Game - March update

This Australian Stock-market competition is about 1 month old now.

Our leader is Flow from NSW with a 13.6% return, in second place is Hermes from the ACT with an 11.2% return.

My fund is now ranked #10 with a 7.8% return.

I am holding all my original purchases, I may make trades this week. I will post my research in the next couple of days.

Below is my performance summary from the ASX site:

Our leader is Flow from NSW with a 13.6% return, in second place is Hermes from the ACT with an 11.2% return.

My fund is now ranked #10 with a 7.8% return.

I am holding all my original purchases, I may make trades this week. I will post my research in the next couple of days.

Below is my performance summary from the ASX site:

Thursday, March 13, 2014

US Stocks Watchlist - Momentum March 2014

The general US market is continuing its positive trend, check the Nasdaq chart below.

This is a good environment for picking-up momentum stocks. Below is my shortlist.

Healthcare

JAZZ DXCM LGND DYAX ANAC

ICPT INSY LCI GWPH FLDM TXMD RCPT HZNP INO BCRX CTIC IDRA ANIP IG CRME

TKMR OHRP ELTP XXII

Discretionary

WYNN MPEL MGM HAR LYV DXYN

WWE XRS CKEC KNDI GLUU

PHOT SKUL NVFY

Materials

DOW MEOH POL CBT KS CSTM MWA ZINC NP HCLP

AA

SBGL ACO URG

Technology

MU YY UBNT DWRE HIMX VNET PFPT CAMP CLFD

VIPS SUNE BITA UCTT CCIH WYY

GTAT TQNT DANG MOBI

Energy

SCTY FANG MTDR EMES

PVA MTRX CAK HYGS QTWW

FCEL GPRE POWR PEIX

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in games at Marketocracy.com & wallstreetsurvivor.com

This is a good environment for picking-up momentum stocks. Below is my shortlist.

Healthcare

JAZZ DXCM LGND DYAX ANAC

ICPT INSY LCI GWPH FLDM TXMD RCPT HZNP INO BCRX CTIC IDRA ANIP IG CRME

TKMR OHRP ELTP XXII

Discretionary

WYNN MPEL MGM HAR LYV DXYN

WWE XRS CKEC KNDI GLUU

PHOT SKUL NVFY

Materials

DOW MEOH POL CBT KS CSTM MWA ZINC NP HCLP

AA

SBGL ACO URG

Technology

MU YY UBNT DWRE HIMX VNET PFPT CAMP CLFD

VIPS SUNE BITA UCTT CCIH WYY

GTAT TQNT DANG MOBI

Energy

SCTY FANG MTDR EMES

PVA MTRX CAK HYGS QTWW

FCEL GPRE POWR PEIX

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in games at Marketocracy.com & wallstreetsurvivor.com

Wednesday, March 12, 2014

Sportsbet.com Fantasy NRL - Round 2

My team got-off to a solid start in R1, scoring 716 points, placing me at #71 on the rankings table.

I will be using my 2 trades this week to strengthen my roster.

I will be bringing in T Aroma ($153k 2RF) from the Sharks. He is relatively cheap and scored well last week. He will likely benefit from P Gallen's long-term injury, picking up some of his stats. A Fifita has also accepted a two week suspension which should also increase Aroma's minutes.

For my second trade, I am bringing-in rookie I Yeo ($87k CTW/2RF) from the Panthers. He is named to start this week after impressing in R1. At $87k he is a steal if can repeat his R1 performance.

Others I liked and considered trading-in were: B Hampton from the Storm & A Docker from the Panthers.

I have N Peats & A Fifita in my team, both are suspended for R2 but I am keeping them on my team, They are both great value pick-ups and worth hanging on to.

Considering these suspensions I am expecting a relatively lower score for R2. My trades should however benefit my team in the longer term.

Good luck in R2.

I will be using my 2 trades this week to strengthen my roster.

I will be bringing in T Aroma ($153k 2RF) from the Sharks. He is relatively cheap and scored well last week. He will likely benefit from P Gallen's long-term injury, picking up some of his stats. A Fifita has also accepted a two week suspension which should also increase Aroma's minutes.

For my second trade, I am bringing-in rookie I Yeo ($87k CTW/2RF) from the Panthers. He is named to start this week after impressing in R1. At $87k he is a steal if can repeat his R1 performance.

Others I liked and considered trading-in were: B Hampton from the Storm & A Docker from the Panthers.

I have N Peats & A Fifita in my team, both are suspended for R2 but I am keeping them on my team, They are both great value pick-ups and worth hanging on to.

Considering these suspensions I am expecting a relatively lower score for R2. My trades should however benefit my team in the longer term.

Good luck in R2.

Thursday, March 6, 2014

2014 Sportsbet Fantasy NRL competition

This competition kicks-off tonight.

I have entered my team.

Below I am sharing with you my research, in-case you haven't done yours.

This season, like last years, will offer heaps of free bets as prizes.

Good Luck!

Low cost Players:

M Ma'u Eels 2RF 87k

J Palavi NZ 2RF 94k

K Edwards Eels 2RF 123k

M Allwood Raiders CTW 87k

C Thompson Bulldogs FLB 87k

Y Tonumaipea Storm CTW 87k

C Tuimavave NZ CTW 105k

D Copely Brisbane CTW 103k

L Tuqiri SSyd CTW 100k

P Carter Titans 2RF/FRF 87k

S Boyd Raiders FRF 87k

J Gavet WST FRF 102k

Nikorima Brisbane HB/58 87k

Cornish Raiders HB/58 94k

Value Players:

B Thompson WST CTW 178k

J Taumalolo NthQ 2RF 194k

N Peats Eels 2RF/FRF 141k

A Docker Panths 2RF 211k

J Sutton Rabbits 58 247k

M Gillett Brisbane 2RF 343k

J Starling Manly FRF 144k

A Blair WST 2RF 253k

I have entered my team.

Below I am sharing with you my research, in-case you haven't done yours.

This season, like last years, will offer heaps of free bets as prizes.

Good Luck!

Low cost Players:

M Ma'u Eels 2RF 87k

J Palavi NZ 2RF 94k

K Edwards Eels 2RF 123k

M Allwood Raiders CTW 87k

C Thompson Bulldogs FLB 87k

Y Tonumaipea Storm CTW 87k

C Tuimavave NZ CTW 105k

D Copely Brisbane CTW 103k

L Tuqiri SSyd CTW 100k

P Carter Titans 2RF/FRF 87k

S Boyd Raiders FRF 87k

J Gavet WST FRF 102k

Nikorima Brisbane HB/58 87k

Cornish Raiders HB/58 94k

Value Players:

B Thompson WST CTW 178k

J Taumalolo NthQ 2RF 194k

N Peats Eels 2RF/FRF 141k

A Docker Panths 2RF 211k

J Sutton Rabbits 58 247k

M Gillett Brisbane 2RF 343k

J Starling Manly FRF 144k

A Blair WST 2RF 253k

2014 ASX Stockmarket Game1 - update

This competition is a 1week old now.

The early leader is Stockbrah from NSW with a 6.8% return, close in second position is Applejack from TAS.

My fund is off to a strong start. I am ranked 106th just off the Leader-board.

Below is my performance summary;

The early leader is Stockbrah from NSW with a 6.8% return, close in second position is Applejack from TAS.

My fund is off to a strong start. I am ranked 106th just off the Leader-board.

Below is my performance summary;

1st prize is $3,000.

My best Marketocracy Fund - 660% 5Year Return!

I may now be the best 5-year returning Fund at Marketocracy.com with a return of over 660%. Marketocracy has not been updating their rankings charts so I cannot confirm my boast until they do.

Below is a table of my Funds returns vs the S&P500. I win!!

Below is a table of my Funds returns vs the S&P500. I win!!

My Fund is ethical with a Biotechnology focus. I am fully invested and riding this Healthcare bubble.

Below are my holdings;

Happy investing!

note - I only own PRAN of the

mentioned stocks and I do not intend buying more stocks in near future. I trade these stocks in a

game at Marketocracy.com & wallstreetsurvivor.com

Monday, February 24, 2014

2014 ASX Sharemarket Game1

This contest begins this week on the 27th of Feb. Here is the link to the game:

http://www.asx.com.au/education/sharemarket-games.htm

I will be constructing my fund with momentum stocks as the ASX Index is trending positively, check its chart below. The Index is breaking above its 5450 level.

Momentum stocks usually do well under these market conditions. I have listed below my latest stock shortlist:

RHC AAD TPM AZJ CSR AMC TGR REA GEM SHL CSL

DMP BGA JHX ORI NVT

SRX ACR NCM AWC

I will be minimizing my diversification to give myself a chance at achieving a really high return. Beware this type of strategy can also give you a really low return.

But since there is only 1 prize ($3,000) may as well go for broke.

Good luck!

& hope to see you on the Leader-board.

http://www.asx.com.au/education/sharemarket-games.htm

I will be constructing my fund with momentum stocks as the ASX Index is trending positively, check its chart below. The Index is breaking above its 5450 level.

Momentum stocks usually do well under these market conditions. I have listed below my latest stock shortlist:

RHC AAD TPM AZJ CSR AMC TGR REA GEM SHL CSL

DMP BGA JHX ORI NVT

SRX ACR NCM AWC

I will be minimizing my diversification to give myself a chance at achieving a really high return. Beware this type of strategy can also give you a really low return.

But since there is only 1 prize ($3,000) may as well go for broke.

Good luck!

& hope to see you on the Leader-board.

Sunday, February 16, 2014

US Stocks Watchlist - Momentum Feb 2014

Healthcare

JAZZ ISIS DXCM PCRX LGND ANAC

GWPH ILMN INCY LCI FLDM RCPT ARWR HZNP BCRX IDRA CRME

NLNK TKMR XXII ELTP

Discretionary

TWC MPEL MGM HAR EDU LYV NYNY

WYNN APOL XRS WWE CKEC KNDI GLUU

PHOT

Materials

POL KS CSTM ZINC HCLP

UFS SBGL BRD BIOA MCIG

RFP CLW ACO ASM

Technology

MU P YY HIMX PFPT AMBA CLFD

VIPS GTAT BITA DL CCIH MITL ADEP JRJC

CMGE HILL GTT YOD IFON

Energy

ETE LNG SCTY FANG EQM CSIQ GST

XTXI MHR PVA MTRX CAK QTWW

GPRE RCON

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com & wallstreetsurvivor.com

JAZZ ISIS DXCM PCRX LGND ANAC

GWPH ILMN INCY LCI FLDM RCPT ARWR HZNP BCRX IDRA CRME

NLNK TKMR XXII ELTP

Discretionary

TWC MPEL MGM HAR EDU LYV NYNY

WYNN APOL XRS WWE CKEC KNDI GLUU

PHOT

Materials

POL KS CSTM ZINC HCLP

UFS SBGL BRD BIOA MCIG

RFP CLW ACO ASM

Technology

MU P YY HIMX PFPT AMBA CLFD

VIPS GTAT BITA DL CCIH MITL ADEP JRJC

CMGE HILL GTT YOD IFON

Energy

ETE LNG SCTY FANG EQM CSIQ GST

XTXI MHR PVA MTRX CAK QTWW

GPRE RCON

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com & wallstreetsurvivor.com

Thursday, February 13, 2014

My Best Ranked Marketocracy Fund

Below is the make-up of my best ranked Marketocracy Fund.

My Fund is ranked #1 for 4 year returns and #2 for three year returns.

This quarter I am up 8.4%.

I am holding over $600k in cash and will be looking to buy into three new positions over the next few days.

The general market is still trending positively (check nasdaq chart below) so I plan to be fully invested. However I am very concerned about the monthly $10B cuts in the stimulus. I have a bad feeling that one of the next cuts may cause a significant market reversal. Should that occur Iwill be ready to kick-in a defensive game plan.

note - I only own PRAN of the

mentioned stocks and I do not intend buying more stocks in near future. I trade these stocks in a

game at Marketocracy.com & wallstreetsurvivor.com

My Fund is ranked #1 for 4 year returns and #2 for three year returns.

This quarter I am up 8.4%.

I am holding over $600k in cash and will be looking to buy into three new positions over the next few days.

The general market is still trending positively (check nasdaq chart below) so I plan to be fully invested. However I am very concerned about the monthly $10B cuts in the stimulus. I have a bad feeling that one of the next cuts may cause a significant market reversal. Should that occur Iwill be ready to kick-in a defensive game plan.

Sunday, February 9, 2014

2014 ASX Sharemarket Game 1 - starts 27th Feb

This year's Game 1 starts on the 27th of Feb and runs till the 11th of June.

There is only 1 prize of $3,000.

I ran my "Krstevski Screen" over the competition stocklist (over 120 stocks). The list below is what popped out. I look for stocks with strong positive price movements (momentum).

RHC TPM AZJ CSR MQG AMC TGR AAD REA

JHX ORI DMP NVT BGA

BRU AWC NCM

and here's some cellar-dwellers:

ASL MML OZL PNA RRL SIR SLR WEB WTF AUT KAR PDN ACR AAX BLY MRM

I will refine and publish my watchlist closer to the start of the comp.

Good Luck!

Monday, February 3, 2014

Australian Healthcare Stocks Watchlist - Feb2014 update

SHL RHC CSL GXL FPH AHZ

PBT PME ADO SOM IPD

TIS

AVH CUV IVX LCT NEU

Be wary about buying into Australian stocks at the moment, the All Ordinaries Index is trading below its 65-Day running average.

Warning - These Healthcare stocks a very volatile and can burn you quickly.

Disclosure - I am already long on PBT RHC GXL NEU & AHZ.

PBT PME ADO SOM IPD

TIS

AVH CUV IVX LCT NEU

Be wary about buying into Australian stocks at the moment, the All Ordinaries Index is trading below its 65-Day running average.

Warning - These Healthcare stocks a very volatile and can burn you quickly.

Disclosure - I am already long on PBT RHC GXL NEU & AHZ.

Saturday, January 18, 2014

US Stocks momentum Watchlist - Jan 2014

Healthcare

ISIS PCRX LGND DYAX MDSO ANAC STAA ANIK

GWPH INCY ALNY INSY LCI ZLTQ HZNP ARWR ATRC DHRM

PBYI NVAX XOMA GALE BCRX LBMH

Discretionary

MPEL MGM HAR EDU LYV LOPE DWA LZB ESI

WYNN XRS HTHT CMLS WWE XUE

AWAY KNDI

Materials

MEOH POL WOR CSTM MWA ZINC ACET HCLP

KS GURE

USEG

Technology

MU P SUNE SSTK HIMX WBMD CAMP CALD

VIPS BITA DL MITL CCIH ADEP JRJC

PFPT HILL WYY EONC

Energy

LNG SPWR JKS GST

SCTY MHR PVA MTRX CAK QTWW

GPRE HYGS

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com & wallstreetsurvivor.com

ISIS PCRX LGND DYAX MDSO ANAC STAA ANIK

GWPH INCY ALNY INSY LCI ZLTQ HZNP ARWR ATRC DHRM

PBYI NVAX XOMA GALE BCRX LBMH

Discretionary

MPEL MGM HAR EDU LYV LOPE DWA LZB ESI

WYNN XRS HTHT CMLS WWE XUE

AWAY KNDI

Materials

MEOH POL WOR CSTM MWA ZINC ACET HCLP

KS GURE

USEG

Technology

MU P SUNE SSTK HIMX WBMD CAMP CALD

VIPS BITA DL MITL CCIH ADEP JRJC

PFPT HILL WYY EONC

Energy

LNG SPWR JKS GST

SCTY MHR PVA MTRX CAK QTWW

GPRE HYGS

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in a game at Marketocracy.com & wallstreetsurvivor.com

Subscribe to:

Posts (Atom)