For the risk-adverse investor this is a very attractive investment opportunity.

I have made the following changes to my model:

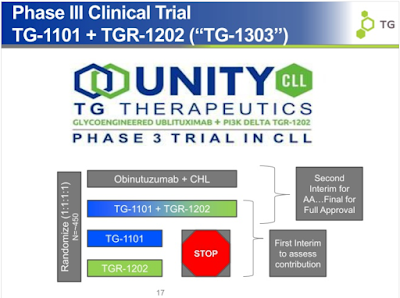

- added the TG-1303 program, this is a pivotal Phase 3 trial now actively recruiting.

- price for TG-1303 is estimated at $80,000 per year. This places it conservatively between the price of Gazyva + chemo & Imbruvica (~$50k & ~$100k).

- 10% market penetration used for TG-1303, the CLL space is crowded however TG-1303's best-in-class safety profile and excellent efficacy should enable it to win sizable market share.

- lowered market penetration estimate for TG1101 & Ibrutinib to 15% from 25% because of the emergence of Acalabrulim. Acalabrulim will be a direct competitor and is showing comparable efficacy and safety profiles to TG1101.

- added royalties and milestone payments.

- added the breakdown of patients between USA & EU and pricing estimates between USA and EU

- lowered price/sales ratio to 8 from 10, considering the change to negative in biotechnology sentiment.

- No value assigned for the sort indication in Multiple Sclerosis (MS). This is a very lucrative indication that alone would be valued higher than all its other current programs.

Below is my model with its detailed assumptions:

Next, from a TGTX PR -> 2016 Goals:

TGTX's Phase3 Trial designs:

Disclosure - TGTX is a core holding of my Marketocracy Fund. This Fund is available for investment.

I do not short stocks.