Northwest Biotherapeutics (NWBO) significantly improved its fundamentals last week by announcing the lifting of a clinical hold from its lead DCVax-L Phase 3 trial for Glioblastoma (GBM). Also announced was the Phase 3 had reached the threshold number of Progression Free Survival (PFS) events, and the trial was several months away from reaching the threshold number of Overall Survival (OS) events. This trial is now fully enrolled with 331 patients and moving forward towards data lock.

These recent positive developments have significantly improved the outlook for NWBO and reduced their risks. After the partial clinical hold was instated in August 2015, NWBO’s trial was perceived to be very troubled. There were perceptions the partial hold would not get lifted and as a result the trial could not complete enrollment and reach its endpoints. There were also doubts NWBO could remain solvent while waiting for the trial to complete.

The latest announcement removes most of those risks. Whatever problem caused the partial hold, while still unknown, cannot now be a problem since the partial hold was lifted. The Phase 3 trial is now fully enrolled and within months of data-lock so the risks the company becomes insolvent and their trial never finishing are also gone.

NWBO is a small biotechnology company in the Immuno-Oncology space. They have two promising vaccine candidates for treating solid tumor cancers. DCVax-L is their lead candidate. Their other candidate is DCVax-Direct for treating various inoperable cancers; this program has completed portion1 of a Phase 1/2 trial and is expected to begin the portion 2 in the near future.

NWBO’s approach to treating cancer is exciting and can theoretically be used to treat ALL solid cancers. They claim their dendritic cell vaccine platform aspires to educate and direct the human immune system to identify, find, and destroy all cancer cells. NWBO’s vaccines are also meant to leave behind an immune memory so when cancer cells try returning they are also destroyed. Other immunotherapy companies fight cancer by targeting a single or several know cancer cells.

The partial clinical hold, instated 18 months ago, was probably the main cause for NWBO’s share price collapse. The company’s market cap dropped from a lofty +$900M to today’s $65M, thereby pricing the Phase 3 trial as a complete failure. Despite the recent positive announcements NWBO's share price remained unchanged. Given the improved fundamentals I see this stock as excessively under-valued.

Unfortunately, the latest announcement does not explain what the partial clinical hold was about. This hurts NWBO management’s credibility and probably keeps new investors away. This perceived management lack of transparency is damaging for NWBO and undoubtedly suppressing its stock’s share price. NWBO had previously said they will not discuss the nature of the partial hold while they are in on-going dialog with regulators. I suspect the dialog with regulators has not completed so there may be good reasons and justification for the continued silence.

NWBO stated they are several months from data-lock in this Phase 3. After data-lock there should be no reason to withhold the partial hold explanation. An explanation would improve investor confidence.

It’s unlikely there ever were serious problems with this trial because during the clinical hold period the trial remained on-going, it was not halted by the FDA. Patients continued to receive their vaccine treatments which would not have been allowed by the FDA had there actually been serious problems.

Another perceived risk with this Phase 3 trial is whether DCVax-L has a chance of showing statistically significant efficacy. I believe it can and rate DCVax-L as having a high likelihood of success. DCVax-L produced very promising results in earlier clinical studies showing both strong signals of efficacy and an excellent safety profile without chemo/radiation type side-effects. Those studies however were small in size and were susceptible to patient selection bias.

DCVax-L has also shown enough promise for foreign regulators to approval it for compassionate use in Germany and its being considered for early approval in the UK. According to NWBO’s latest 8K, a substantial number of patients have already been treated on a compassionate basis under an Expanded Access Protocol.

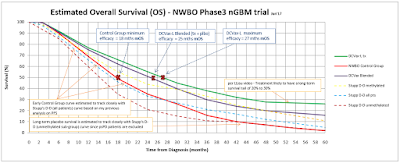

I have run several analyses to try and predict the efficacy of this Phase 3 trial based on assumptions I have created from my knowledge of the trial. My analysis results give DCVax-L a strong possibility of showing statistically significant efficacy on their PFS primary endpoint. My model below gives DCVax-L 16 month PFS versus 6 months for placebo, a 10 month treatment benefit.

DCVax-L is further validated by being included in combination trials with FDA approved Checkpoint Inhibitors (CI). At least two Phase 2 combination trials are planned for 2017. Already announced is a trial with Merck’s (MRK) Keytruda for colorectal cancer. And the second, unannounced but listed on clinicaltrials.gov, is a trial with Bristol-Myers’ (BMY) Opdivo for recurrent GBM. Both these trials are no longer at risk of being delayed by the partial clinical hold.

For the risk-averse investor this stock at $65M market cap now presents a tremendous near-term, risk/reward profile.

Other Risks:

* Should this Phase 3 trial fail, it may become very difficult for NWBO to remain solvent.

* NWBO will require more funding around mid-2017 and it may come under dilutive terms.

ADDED - Additional funding may be required before 10th of March 2017 should the company be required to repurchase 11M in Convertible Senior Notes

* There is uncertainty about the intentions of NWBO’s major stakeholder Neil Woodford. His relationship with NWBO appears hostile or strained at best.

* NWBO continues to be targeted in the media despite its very low valuation.

Disclosure:

I am long NWBO. I do not short stocks.