I am in a strong BUY mode. But also keeping a close eye on Russia's Ruble, its collapse could end our party early!

Below is my short-list of stocks showing strong positive price movements:

TGTX KITE OVAS AGIO RCPT TTPH FOLD PTCT AMAG AMED ALDR EXAS

RDUS IG CMRX INGN SKH

ESPR NWBO OMER ADXS CEMP

CUR NVIV

note

- I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Showing posts with label M100 Stock Portfolio. Show all posts

Showing posts with label M100 Stock Portfolio. Show all posts

Tuesday, January 6, 2015

Sunday, December 14, 2014

I am a Marketocracy Master now!! (bench)

Marketocracy has recognized my Portfolio's stella long-term performance and promoted me to their Top Portfolios Managers list.

Over the last 10 years my Portfolio has beaten the performance of all USA listed Morningstar Mutual Funds.

This link shows my Funds performance: http://www.marketocracy.com/managers.php?manager=781

Now US citizens can invest in my Portfolio through a SMA with foliofn.

disclosure: I get 0.3% commissions on all funds in my Fund.

Over the last 10 years my Portfolio has beaten the performance of all USA listed Morningstar Mutual Funds.

This link shows my Funds performance: http://www.marketocracy.com/managers.php?manager=781

Now US citizens can invest in my Portfolio through a SMA with foliofn.

disclosure: I get 0.3% commissions on all funds in my Fund.

Saturday, November 8, 2014

US Healthcare Stocks Watchlist - updated Nov 2014

US markets are trending positively, check Nasdaq chart below:

Similarly the Nasdaq Biotech index is also positive, check its chart below:

I am in strong BUY mode.

Below is my short-list of stocks also showing strong positive price movements:

IG RDNT MACK CBPO TGTX AGN EW MNK

AGIO SCLN AVNR TTPH ANAC OVAS RGEN AKRX EXAS

NWBO UNIS RCPT ANIP MDXG ESPR

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Similarly the Nasdaq Biotech index is also positive, check its chart below:

I am in strong BUY mode.

Below is my short-list of stocks also showing strong positive price movements:

IG RDNT MACK CBPO TGTX AGN EW MNK

AGIO SCLN AVNR TTPH ANAC OVAS RGEN AKRX EXAS

NWBO UNIS RCPT ANIP MDXG ESPR

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Monday, June 30, 2014

US Healthcare Stocks Watchlist - updated June2014

Below is my list of companies showing strong positive price movements:

SHPG PCRX GWPH AXDX ANIK DRTX ANIP IG

ITMN AKRX LCI ENTA RGEN BDSI FLML ENZ

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

SHPG PCRX GWPH AXDX ANIK DRTX ANIP IG

ITMN AKRX LCI ENTA RGEN BDSI FLML ENZ

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Monday, June 16, 2014

My best Marketocracy Fund

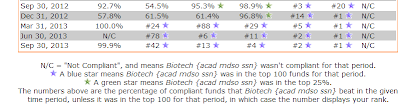

My fund, BK11 continues to feature in Marketocracy's M100.

Marketocracy is about to release updated rankings.

My fund will slip from #1 to #3 in the rankings for 4 year returns.

This fund held the #1 ranking for the 5 previous quarters. I unfortunately incurred heavy losses during the biotech sell-off earlier this year which has hurt my ranking.

I have re-shuffled my fund's positions, it is now back in an aggressive posture. Should the general market rally positively my fund should see large returns. Below are its holdings:

This is the updated Top10 4year ranking:

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Marketocracy is about to release updated rankings.

My fund will slip from #1 to #3 in the rankings for 4 year returns.

This fund held the #1 ranking for the 5 previous quarters. I unfortunately incurred heavy losses during the biotech sell-off earlier this year which has hurt my ranking.

I have re-shuffled my fund's positions, it is now back in an aggressive posture. Should the general market rally positively my fund should see large returns. Below are its holdings:

This is the updated Top10 4year ranking:

note - I trade the mentioned stocks in a game at Marketocracy.com. I trade with virtual money NOT real money.

Friday, May 30, 2014

My US Stocks Watchlist - May 2014

LNG FANG CRZO PVA GST CPE ENSV

EMES PSXP CRK BAS PES REX AXAS WLB

Healthcare

FRX PCRX HZNP AXDX ANIK RGEN CUR ANIP IG

QCOR ITMN RDNT

Discretionary

MAR RCL H LYV SWHC CKEC HAR SNA

EA

RDI

Materials

DOW HCLP LYB NNBR POL WLK

AA CENX GPRE SLCA SWC

CXDC SSLT

Technology

MU NXPI VIPS SUNE BITA MITL

Z ARRS TQNT GTAT AMKR MXWL

Our market sentiment has changed to positive according to Nasdaq's chart. Nasdaq is now charting above its 50-day running average.

I am using all my cash to buy into the market.

note - I do not own any of these stocks nor do I intend to buy any in the near future. I trade them in game at Marketocracy.com

Thursday, March 6, 2014

My best Marketocracy Fund - 660% 5Year Return!

I may now be the best 5-year returning Fund at Marketocracy.com with a return of over 660%. Marketocracy has not been updating their rankings charts so I cannot confirm my boast until they do.

Below is a table of my Funds returns vs the S&P500. I win!!

Below is a table of my Funds returns vs the S&P500. I win!!

My Fund is ethical with a Biotechnology focus. I am fully invested and riding this Healthcare bubble.

Below are my holdings;

Happy investing!

note - I only own PRAN of the

mentioned stocks and I do not intend buying more stocks in near future. I trade these stocks in a

game at Marketocracy.com & wallstreetsurvivor.com

Thursday, February 13, 2014

My Best Ranked Marketocracy Fund

Below is the make-up of my best ranked Marketocracy Fund.

My Fund is ranked #1 for 4 year returns and #2 for three year returns.

This quarter I am up 8.4%.

I am holding over $600k in cash and will be looking to buy into three new positions over the next few days.

The general market is still trending positively (check nasdaq chart below) so I plan to be fully invested. However I am very concerned about the monthly $10B cuts in the stimulus. I have a bad feeling that one of the next cuts may cause a significant market reversal. Should that occur Iwill be ready to kick-in a defensive game plan.

note - I only own PRAN of the

mentioned stocks and I do not intend buying more stocks in near future. I trade these stocks in a

game at Marketocracy.com & wallstreetsurvivor.com

My Fund is ranked #1 for 4 year returns and #2 for three year returns.

This quarter I am up 8.4%.

I am holding over $600k in cash and will be looking to buy into three new positions over the next few days.

The general market is still trending positively (check nasdaq chart below) so I plan to be fully invested. However I am very concerned about the monthly $10B cuts in the stimulus. I have a bad feeling that one of the next cuts may cause a significant market reversal. Should that occur Iwill be ready to kick-in a defensive game plan.

Saturday, December 28, 2013

Thursday, December 26, 2013

My best Marketocracy Fund (BK11) - check it!

Below are my current holdings.

This Fund is still ranked #1 for 3 year returns @ Marketocracy.com. It also continues to features in their M100.

The next link is my public page.

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc

This Fund is still ranked #1 for 3 year returns @ Marketocracy.com. It also continues to features in their M100.

| Symbol | Label | Price | Shares | Value | Portion of Fund | Gains | Today | Inception Return | Current Return | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACAD | click me | $26.31 | 36,000 | $947,160.00 | 21.12% | $1,255,801.76 | 1.54% | 710.07% | 710.07% | Details | TOP |

| MDSO | click me | $60.92 | 8,540 | $520,256.80 | 11.60% | $349,008.88 | 0.13% | 203.80% | 203.80% | Details | |

| PRAN | click me | $7.01 | 51,760 | $362,837.60 | 8.09% | $137,209.08 | -1.68% | 22.08% | 68.86% | Details | |

| DYAX | click me | $7.68 | 36,500 | $280,320.00 | 6.25% | $52,788.48 | 0.39% | 13.99% | 39.50% | Details | |

| WX | click me | $37.68 | 6,680 | $251,702.40 | 5.61% | $51,063.32 | 1.76% | 25.45% | 25.45% | Details | |

| ANAC | click me | $17.53 | 13,940 | $244,368.20 | 5.45% | $49,008.68 | 2.76% | 25.09% | 25.09% | Details | MIDDLE |

| HALO | click me | $15.57 | 14,190 | $220,938.30 | 4.93% | $19,778.53 | 1.30% | 9.83% | 9.83% | Details | |

| ILMN | click me | $108.12 | 2,000 | $216,240.00 | 4.82% | $15,553.54 | 0.58% | 7.75% | 7.75% | Details | |

| CHTP | click me | $4.45 | 33,980 | $151,211.00 | 3.37% | $8,354.87 | 1.36% | 5.85% | 5.85% | Details | |

| INCY | click me | $50.82 | 3,990 | $202,771.80 | 4.52% | -$42,186.79 | -0.94% | -13.49% | 0.11% | Details | |

| ACT | click me | $164.90 | 1,210 | $199,529.00 | 4.45% | $1,927.44 | -0.65% | 0.81% | 0.10% | Details | BOTTOM |

| GILD | click me | $74.96 | 2,690 | $201,642.40 | 4.50% | $100,972.69 | -0.05% | 23.34% | -0.60% | Details | |

| AXDX | click me | $13.78 | 12,800 | $176,384.00 | 3.93% | -$23,040.00 | -0.58% | -11.55% | -11.55% | Details | |

| SSN | click me | $0.42 | 391,770 | $166,463.07 | 3.71% | -$243,986.25 | -2.10% | -49.17% | -28.23% | Details |

The next link is my public page.

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc

Friday, October 4, 2013

My best Marketocracy Fund Performance

Below are the latest holdings of my Fund.

Year to date I am up 94.83%.

I am almost fully invested just a little cash up my sleeve.

All eyes on the US political situation. I wouldn't think their politicians would allow a default, they and their families have too much personal wealth in the market to lose. But then again this political situation seems to be getting crazier every day so maybe they will cut their noses to spite their faces.

If all goes well and a late deal is struck again I will be looking to a add another position in the coming weeks otherwise I am preparing to lighten my positions significantly.

This Fund ranks #1 and #2 for 3 and 2 year returns.

This is a link to my performance page

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

Note - Do not try trading these stocks at home they are very volatile. My Fund does not hold real money it is part of a game at Marketocracy.com

Year to date I am up 94.83%.

I am almost fully invested just a little cash up my sleeve.

All eyes on the US political situation. I wouldn't think their politicians would allow a default, they and their families have too much personal wealth in the market to lose. But then again this political situation seems to be getting crazier every day so maybe they will cut their noses to spite their faces.

If all goes well and a late deal is struck again I will be looking to a add another position in the coming weeks otherwise I am preparing to lighten my positions significantly.

| Symbol | Value | Current Return | Days Held | Selection Return | Activity Return |

| ACAD | $1,038,240 | 761.60% | 328 | 1187.50% | -425.90% |

| CLDX | $506,231 | 184.10% | 154 | 194.90% | -10.80% |

| MDSO | $422,986 | 147.00% | 328 | 149.40% | -2.40% |

| NPSP | $402,683 | 109.50% | 3912 | 18.10% | 39.50% |

| PCRX | $316,163 | 42.60% | 42 | 43.60% | -1.00% |

| STML | $288,051 | 35.90% | 42 | 43.90% | -8.00% |

| DYAX | $260,610 | 29.70% | 327 | 134.10% | -125.30% |

| ZLCS | $287,424 | 29.20% | 28 | 53.90% | -24.60% |

| RPTP | $261,366 | 18.80% | 42 | 18.20% | 0.60% |

| CPRX | $247,586 | 12.40% | 13 | 16.40% | -4.00% |

| INSY | $137,060 | 7.40% | 13 | 5.40% | 2.00% |

| CUR | $195,531 | -1.60% | 13 | 2.00% | -3.60% |

| IMUC | $226,950 | -12.80% | 65 | -13.30% | 0.50% |

| SSN | $190,792 | -17.70% | 588 | -83.80% | 39.50% |

| Cash | $240,000 |

This Fund ranks #1 and #2 for 3 and 2 year returns.

This is a link to my performance page

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

Note - Do not try trading these stocks at home they are very volatile. My Fund does not hold real money it is part of a game at Marketocracy.com

Tuesday, September 3, 2013

My best Marketocracy.com Fund

Below are the holdings of my best ranked Fund.

This Fund now ranks #1 and #2 for 3 and 2 year returns.

Year to date I am up 62.3%, definitely one of my best performance years. This year has also been a bumper one for the entire Healthcare sector.

I am almost fully invested in Heathcare with a little cash up my sleeve.

Will be looking to a add another position in the next week or so. My short term strategy may change depending on how things pan out in Damascus.

Symbol Value Return Days Held

ACAD $718,560.00 580.81% 298

MDSO $381,908.80 123.02% 298

SNTS $348,384.40 70.16% 214

CLDX $299,518.80 68.10% 124

NPSP $302,706.00 57.47% 3882

PRAN $264,438.00 43.58% 298

LGND $273,632.10 22.80% 61

NBIX $210,390.80 11.47% 4060

RPTP $240,741.20 9.43% 12

STML $220,720.50 4.11% 12

PCRX $216,595.60 -2.32% 12

PRSC $205,862.80 -5.27% 61

IMUC $242,250.00 -6.94% 35

ZLCS new

This is a link to my performance page

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

Note - Do not try trading these stocks at home they are very volatile. My Fund does not hold real money it is part of a game at Marketocracy.com

This Fund now ranks #1 and #2 for 3 and 2 year returns.

Year to date I am up 62.3%, definitely one of my best performance years. This year has also been a bumper one for the entire Healthcare sector.

I am almost fully invested in Heathcare with a little cash up my sleeve.

Will be looking to a add another position in the next week or so. My short term strategy may change depending on how things pan out in Damascus.

Symbol Value Return Days Held

ACAD $718,560.00 580.81% 298

MDSO $381,908.80 123.02% 298

CLDX $299,518.80 68.10% 124

NPSP $302,706.00 57.47% 3882

PRAN $264,438.00 43.58% 298

LGND $273,632.10 22.80% 61

RPTP $240,741.20 9.43% 12

STML $220,720.50 4.11% 12

PCRX $216,595.60 -2.32% 12

IMUC $242,250.00 -6.94% 35

ZLCS new

This is a link to my performance page

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

Note - Do not try trading these stocks at home they are very volatile. My Fund does not hold real money it is part of a game at Marketocracy.com

Thursday, July 4, 2013

New positions for my M10/M100 Fund

ISIS

PRSC

LGND

BIOS

I used my big cash position to add these stocks into my Fund.

I am feeling positive about the general market again. Am invested fully with micro value positions.

Should the market turn South I may feel a lot of hurt.

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

PRSC

LGND

BIOS

I used my big cash position to add these stocks into my Fund.

I am feeling positive about the general market again. Am invested fully with micro value positions.

Should the market turn South I may feel a lot of hurt.

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

Tuesday, June 18, 2013

My M10 & M100 Marketocracy Fund (791branko) - updated

Below are my current holdings.

Quarter2 has been terrific for my fund, returning over 19%. My YTD return is over 51%.

I am more optimistic about the state of our market. It's bubbling along resiliently and I do not see a major danger in the near term (apart from summer being traditionally a weak period for the market).

The general market has very quickly turned negative (stimulas easying announcement, options expiry), am I feeling a little embarrased! Absent of a significant market rally by mid next week I will be reducing my positions (updated 21st June).

I am fully invested in Heathcare stocks with a large position in ACAD.

As always, if the broad market shows signs of weakness I'll reshape my fund.

My Fund is now part of Marketocracy's elite M10 Index and it still features in their M100 Index.

Marketocracy is about to publish their end of 2013 Q1 rankings. My Fund will be shown as ranked #1 for 3 year returns and #5 for 2 year returns. The link below shows my 5 year return.

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

I hope to shortly overtake Justin Uyehara for the #1 ranking in 5 year returns of the "Top Ranked Funds".

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

Quarter2 has been terrific for my fund, returning over 19%. My YTD return is over 51%.

I am more optimistic about the state of our market. It's bubbling along resiliently and I do not see a major danger in the near term (apart from summer being traditionally a weak period for the market).

The general market has very quickly turned negative (stimulas easying announcement, options expiry), am I feeling a little embarrased! Absent of a significant market rally by mid next week I will be reducing my positions (updated 21st June).

I am fully invested in Heathcare stocks with a large position in ACAD.

As always, if the broad market shows signs of weakness I'll reshape my fund.

My Fund is now part of Marketocracy's elite M10 Index and it still features in their M100 Index.

Marketocracy is about to publish their end of 2013 Q1 rankings. My Fund will be shown as ranked #1 for 3 year returns and #5 for 2 year returns. The link below shows my 5 year return.

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

I hope to shortly overtake Justin Uyehara for the #1 ranking in 5 year returns of the "Top Ranked Funds".

| Symbol | Value | Return | Days Held |

| ACAD | $1,059,520 | 574.16% | 222 |

| MDSO | $308,337 | 80.05% | 222 |

| ACRX | $356,326 | 78.45% | 125 |

| SNTS | $332,914 | 62.60% | 138 |

| $239,020 | 47.19% | 218 | |

| $210,244 | 40.19% | 2755 | |

| CLDX | $218,020 | 22.36% | 48 |

| AMRI | $213,202 | 21.16% | 1855 |

| NBIX | $183,677 | -2.69% | 3984 |

| CADX | $220,443 | -3.73% | 55 |

| NPSP | $179,694 | -6.52% | 3806 |

| TSRO | $165,764 | -8.73% | 13 |

| $191,240 | -14.89% | 55 |

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

Wednesday, April 17, 2013

My Marketocracy holdings

Below are my current holdings.

Quarter 1 was terrific for my fund up over 27%. And so far this quarter I'm up over 7%.

I am very concerned about the current short term market state. Terrorism strike, Peninsula tension, Iran hostility, euro debt all have me edge. I have already sold several positions and may increase my cash position. If the market deteriorates quickly I'll buy into short etfs.

My Fund continues to feature in Marketocracy's M100, and it is ranked #1 for 3 year returns.

The link below shows its 5 year return. I will shortly overtake Justin Uyehara for the #1 ranking in 5 year returns if my momentum continues for another month or two.

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

Quarter 1 was terrific for my fund up over 27%. And so far this quarter I'm up over 7%.

I am very concerned about the current short term market state. Terrorism strike, Peninsula tension, Iran hostility, euro debt all have me edge. I have already sold several positions and may increase my cash position. If the market deteriorates quickly I'll buy into short etfs.

My Fund continues to feature in Marketocracy's M100, and it is ranked #1 for 3 year returns.

The link below shows its 5 year return. I will shortly overtake Justin Uyehara for the #1 ranking in 5 year returns if my momentum continues for another month or two.

http://portfolio.marketocracy.com/cgi-bin/WebObjects/Portfolio.woa/ps/FundPublicPage/source=MlPfAlMhDnDkElAdMaKiAbOc/maxDays=1826

| Symbol | Value | Inception Return | Days Held |

| ACAD | $693,840.00 | 367.39% | 159 |

| Cash | $466,731.00 | ||

| CSU | $234,175.00 | 44.20% | 155 |

| GILD | $214,281.20 | 48.97% | 2692 |

| SNTS | $288,824.90 | 41.07% | 75 |

| MDSO | $233,398.20 | 36.29% | 159 |

| DYAX | $234,666.60 | 33.05% | 158 |

| CBPO | $246,367.50 | 30.40% | 50 |

| NEO | $197,845.80 | 16.78% | 53 |

| F | $262,400.00 | 13.55% | 173 |

| ACRX | $199,715.20 | 0.02% | 62 |

| AMRI | $166,332.80 | -18.13% | 1792 |

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

Wednesday, February 6, 2013

My M100 Fund positions

I finished 2012 strongly, finishing up about 26% for the year.

My positive momentum has carried into 2013, I am up about 9% ytd.

Marketocracy just released their new performance rankings.

My fund is now the best ranked at Marketocracy for 3 year returns (that's numero uno baby!!).

I will be buying into a new position shortly from profits I took off ACAD (after Cramer's pump a couple of weeks ago).

Otherwise I am fully invested and riding the 2013 wave of optimism. Hoping this is a strong wave.

Note - My portfolio does not hold real money. It is part of a stock market simulation @ Marketocracy.com

My positive momentum has carried into 2013, I am up about 9% ytd.

Marketocracy just released their new performance rankings.

My fund is now the best ranked at Marketocracy for 3 year returns (that's numero uno baby!!).

I will be buying into a new position shortly from profits I took off ACAD (after Cramer's pump a couple of weeks ago).

Otherwise I am fully invested and riding the 2013 wave of optimism. Hoping this is a strong wave.

| Symbol | Value | Inception Return | Days Held | YTD Return |

| ACAD | $351,680.00 | 173.92% | 89 | 31.83% |

| INFI | $288,434.30 | 81.78% | 84 | 1.29% |

| F | $263,600.00 | 13.81% | 103 | 0.23% |

| SNTA | $236,392.00 | 14.52% | 53 | 19.96% |

| Cash | $203,000.00 | |||

| SNTS | $202,657.00 | -1.02% | 5 | 18.21% |

| MDSO | $201,458.60 | 17.64% | 89 | 19.09% |

| MDVN | $199,430.00 | 226.35% | 2322 | 9.62% |

| CSU | $198,835.00 | 22.44% | 85 | 10.81% |

| REGN | $181,835.80 | -8.66% | 67 | -0.23% |

| DYAX | $177,846.60 | 0.84% | 88 | -12.36% |

| GILD | $167,024.80 | 28.40% | 2622 | 3.90% |

| PCYC | $131,146.50 | 47.95% | 256 | 20.84% |

Subscribe to:

Posts (Atom)